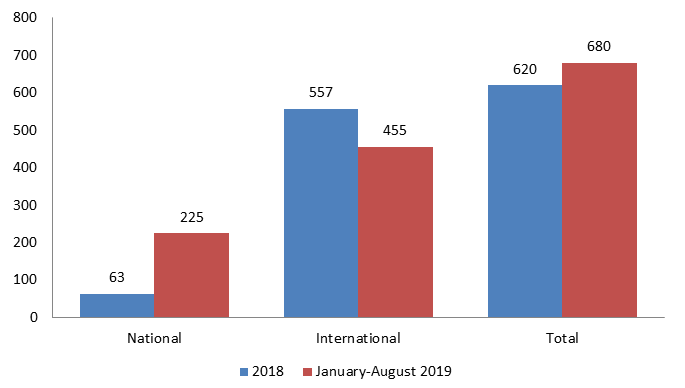

Up to August of this year, the CNMV has issued 225 warnings on entities not authorised to provide investment services, known as financial boiler rooms. This amount is triple the number of warnings issued in the past year so that investors have the necessary information to avoid being victims of fraud.

In the last ten years, the increasing development of technologies and digital communication channels have facilitated the emergence of new methods to commit fraud through the Internet and social networks. These channels offer easy access to potential victims and facilitate dissemination at a low cost. This is why, in the past few months, the CNMV has reinforced its activity in the digital area, intensifying its searches in blogs, forums, social networks, etc., as it is aware of the context in which technologies and digital communication channels are triggering significant changes in the behaviour of these financial boiler rooms. Through these actions, the number of unauthorised entities detected, and about which the CNMV has issued warnings to investors, has increased significantly.

New methods of committing fraud have also been detected. One of these methods is the so-called recovery rooms, which are companies that attract clients who have been victims of financial boiler rooms, in exchange for an up-front payment. Another activity that involves risk, about which the CNMV has recently issued a warning, is that of financed trading accounts, which are services that offer the possibility of accessing a securities account to trade without placing own capital at risk, but rather that of the website of the actual entity offering the service. These accounts oblige users to take a training course, requiring an up-front payment to attend the course, and their users may be victims of fraud or deceit with regard to the possibility of actually accessing these financed trading accounts.

Among the strategies that financial boiler rooms have started to use to attract investors is that of offering financial products linked to cryptocurrencies, in an attempt to take advantage of the importance given by the public to these assets.

The tasks of detecting, reporting and eliminating these fraudulent practices have also been reinforced with the conclusion of various agreements with the Police and the Civil Guard in 2019, establishing a framework for collaboration for the exchange of information with both institutions to expedite the detection of financial boiler rooms and to facilitate rapid and efficient action in this regard.

In addition to the warnings about national unauthorised entities that have been issued so far this year, the CNMV has issued 455 warnings on financial boiler rooms that operate from other European countries. In this area, there has also been an increase of 24% compared to the previous year.

Investors may consult the Search engine for entities to be wary of available on the CNMV’s website or be informed of new national and international warnings. The investor service number 900 535 015 is also provided.

In addition, the CNMV has published ten tips to avoid financial boiler rooms for investors, aimed at facilitating the detection of and avoid being a victim of any of these types of frauds.